Five different methods for HDFC credit card bill payment online, statement generation and card details enquiry using your mobile or laptop

HDFC Credit Card Bill Payment Online

There are mainly two methods of credit card bill payments:

Offline Payments

For offline credit card bill payment, you personally need to visit bank branches and this may add a little more cost to your credit card bill payments as banks may charge some extra money for cash handling and you also need to spend travelling expenses to personally visit the bank branch. Visiting Bank Branches is not even safe as the corona pandemic is on its peak.

Online Payments

Paying your credit card bills online is rather more safe, convenient, economical as compared to offline payments. There are numerous methods of paying HDFC credit card bill online some of them are as below:

Hdfc Credit Card Bill Payment Online Methods:

I. By using HDFC Bank Internet Banking

If you are already using HDFC Bank Internet banking you can pay your credit card bills by simply signing in HDFC Bank Internet banking and visit cards section on the top bar of your internet banking Home page.

You can also generate credit card statements, make bill payments, enquire card details and much more using HDFC Internet Banking

II. By using HDFC Credit card Login

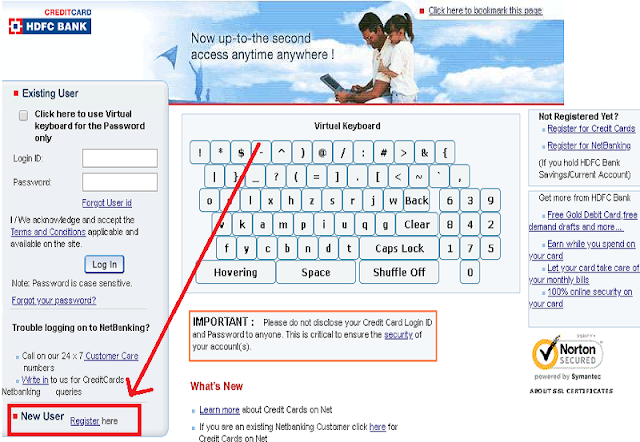

If you are not maintaining any saving or current account in HDCF Bank you can also pay your credit card bills by using HDFC Bank credit card internet banking. check out step-wise process for HDFC bank credit card internet banking Registration login.

For HDFC Credit card internet banking Registration click the link given below a page will be displayed on your screen click on Register online radio button and register yourself using your card details.

HDFC Credit Card Login and Sign up Process

After registration, you can easily pay your credit card bills, generate card statement, and enquire your card details online.

https://www.hdfcbank.com/personal/ways-to-bank/online-banking/credit-card-netbanking

III. By NEFT

You can also pay your credit bills by transferring funds from any other bank account to your HDFC Bank Credit Card account electronically. For Online credit card bill payment through NEFT you can insert your Card Number in place of account number and Use IFSC Code HDFC0000128 and name printed on your card as Beneficiary.

IV. By CREDS App

Creds is a unique App for convenient and easy payment of credit card bills online which rewards users for the bill payment.

You just need to register in creds app and add your card credit card details once. Creds is a wonderful app not only pays your bills but also provides you credit card statement and even informs you about any type of charges or other deductions from your credit cards.

V. By using Google Pay/Paytm

You can also pay your HDFC Credit card bill online by using google pay or Paytm apps. You just need to register in Google pay or Paytm using your registered mobile numbers

customerservices.cards@hdfcbank.com

Important Dates and Terms

- Statement date –It is the date on which the Credit Card statement is generated. If you were late in paying the previous bill, you will be charged interest, which will be calculated taking the statement date as the first day.

- Payment due date –This is the date by which the bank expects to receive the due amount from you.

- Billing cycle –This is the 30-day period for which the statement is generated. It is the period between two consecutive statement dates.

- Grace period – it is the number of days between a credit card statement date and payment due date and interest does not accrue during the grace period. If not paid within the grace period, the interest will become applicable. For example, if a statement is issued on August 31st and payment is due on September 22nd, the grace period is the time between both dates.

- Transaction details –This includes the purchases and borrowings made during a billing cycle, along with the date, amount, and particulars of the transaction. Apart from the purchases, it will also include cash advances, interest, and charges (if applicable).

- Total amount due –This is the aggregate of the transaction value during the billing period, any amount outstanding carried forward from the earlier bill, the interest charged, late payment fee, and any other charge or penalty that may be applicable.

- Minimum amount due – the minimum amount you are required to pay on or before the payment due date to maintain your card account. The minimum amount due could be anywhere from 5% or Rs 200, whichever is more of the total amount due.

- Transaction details –This is the detail of purchases and borrowings made during a billing cycle, along with the date, amount, and particulars of the transaction. Apart from the purchases, it will also include cash advances, interest, and charges if applicable.

- Total amount due –This is the aggregate of the transaction value during the billing period.

COMMENTS