sbi gold loan for all your legitimate funds requirement.

SBI Gold loan scheme application process:

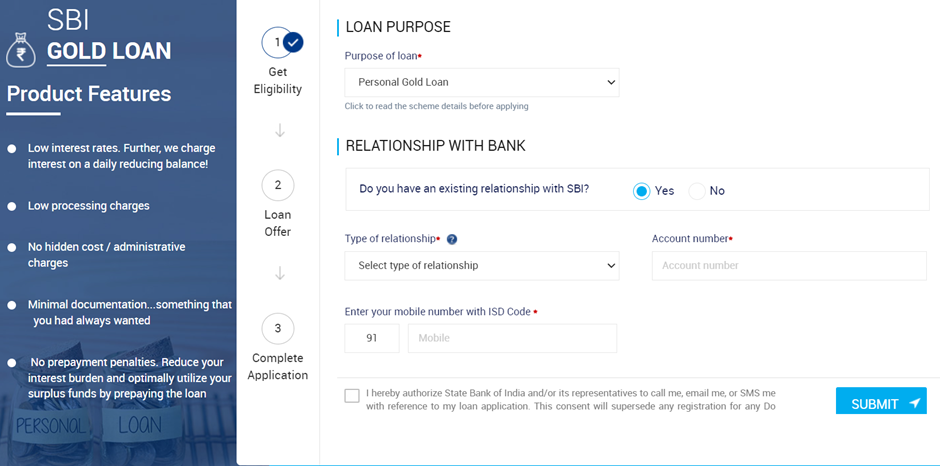

1. Online Process: click link below for online

application as shown in image below and fill the form and submit application.

https://onlineapply.sbi.co.in/personal-banking/gold-loan

Offline Application: By visiting nearest SBI branch

Telecalling: Dial 1800-11-2211 for more information/

applying through Contact Centre.

Give a

Missed Call on 7208933143 or SMS “GOLD” on 7208933145 to get a call back from

our Contact Centre.

Types of SBI gold loan:

- Gold Loan.

- Liquid Gold Loan.

- Bullet Repayment Gold Loan.

SBI gold loan

Eligibility:

·

Min Age : 18 years and above

·

Profession : Any individual

(singly or jointly) with Steady source of income including: Bank’s Employees,

Pensioners. (No Proof of income required)

SBI gold loan purpose:

You

can avail a gold loan in order to finance various needs, such as for

educational purposes, medical emergencies, going on a holiday or any other

legitimate requirement of funds.

SBI gold loan

quantum:

·

Maximum Loan Amount : Rs 50.00 lacs

·

Minimum Loan Amount :

Rs 20,000 /-

Actual loan amount

depends on actual value of gold ornaments/coins pledged. As per RBI you cannot

pledge gold coins more than 50 grams.

SBI gold

loan Margin:

o Gold Loan: 25%

o Liquid Gold Loan: 25%

o Bullet Repayment Gold Loan: 35%

SBI gold loan repayment period:

Repayment

Gold Loan EMI based : The

repayment of Principal and Interest will be commenced from the month following

the month of disbursement.

Maximum repayment period: 36 Months

Liquid Gold Loan: Overdraft Account

with transaction facility and monthly interest is to be served.

Maximum repayment period: 36 Months

Bullet Repayment

Gold Loan: On or before the term of the loan/ on closure of account.

Maximum repayment period: 12 Months

Note: you can close gold loan any

time without penality with your own funds.

SBI gold loan documentation:

To

Apply Loan

·

Application for Gold Loan with two copies of photographs.

·

Proof of Identity

( i)

Passport ii) Voter ID Card iii) PAN Card iv) Government/Defence ID Card v) ID

Card of reputed employers vi) Driving License vii) Pension Payment Orders

issued to the retired employees by Central/State Government Departments, Public

Sector Undertakings viii) Photo ID Cards issued by Post Offices ix) Photo

identity Cards issued to bonafide students by a University, approved by the

University Grants Commission)

·

proof of Address

(Passport

ii) Driving license iii) Credit Card Statement- not more than 3 months old iv)

Salary slip v) Income/Wealth Tax Assessment Order vi) Electricity Bill- not

more than 6 months old vii) Landline Telephone Bill - not more than 3 months

old viii) Bank account statement ix) Letter from reputed employer)

·

Witness Letter in case of illiterate borrowers.

Time of Disbursement

·

DP note and DP Note Take Delivery Letter.

·

Gold Ornaments Take Delivery Letter.

·

Arrangement Letter

SBI gold loan rate of interest:

RATE

OF INTEREST (up to 30.06.2022) Mean

Rate of Interest: 7.40%

|

Scheme |

1 year MCLR |

Spread over 1 year MCLR |

Effective Interest Rate |

|

Gold Loan (all variants) |

7.10% |

0.30% |

7.40% |

Rate of interest are always subject

to change. Kindly confirm rates while application.

SBI gold loan charges:

Processing-fee

0.50% of the Loan amount minimum Rs500/- + applicable GST.

COMMENTS